Maryland Uninsured Driver Accident Attorney

Car crashes are frightening, stressful, expensive, and common. If you have ever been in a car accident, you know that the medical care and property damage can cost thousands. Fortunately, in most cases, insurance covers many of the related expenses. Without insurance coverage, a car crash can be financially ruinous.

If you were in a crash caused by an uninsured motorist, then you might wonder what rights you have to collect compensation for your injuries and other damages. While you might feel that you are out of luck, this might not be the case.

In Maryland, car insurance companies must provide uninsured motorist coverage. What this means is that if you are insured, you can collect insurance from your own carrier if the other driver lacks insurance.

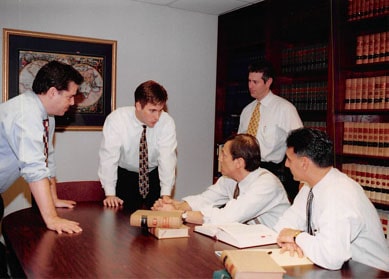

While dealing with your own insurance company might sound like it would be simple, such is not always the case. To learn your options and rights, contact a Maryland car crash attorney. The experienced lawyers at Berman | Sobin | Gross LLP have decades of experience representing clients who were injured by uninsured motorists. Call us today at 410-769-5400 to schedule a consultation.

How Does Uninsured Motorist Coverage Work?

If an uninsured motorist causes a crash, there is a good chance that the uninsured driver also lacks assets that would cover the costs of the injuries to the other driver, passenger or pedestrian. The liable driver’s lack of insurance and finances is clearly a problem because the injury victim could end up without any way to collect compensation.

Fortunately, uninsured motorist coverage will kick in to cover the expenses that the uninsured driver would have paid for had he or she been insured. These policies protect people who have done the right thing by maintaining insurance and driving responsibly from other less responsible individuals.

How Much Uninsured Coverage Will Apply?

Your policy only includes the uninsured coverage that you have selected and paid for as part of your insurance policy. It is important to review that coverage in order to understand what is offered by your insurer. While your provider is legally required to provide uninsured coverage, it only has to provide the mandatory minimum coverage amount. That amount is only $30,000 per person injured in a crash up to $60,000 for all injuries. The coverage also includes $15,000 in property damage. Those amounts are not much when it comes to the potential injuries involved in car crashes. Even a visit to the emergency room can cost thousands, and total bills can quickly add up to tens of thousands of dollars.

It is a good idea to review your policy to decide if you would like to increase your coverage.

What if the Other Driver Only Carries Minimum Coverage?

In some cases, drivers may have car insurance but only carry the mandated minimum amount. As mentioned above, the injuries and damage caused in a serious car crash can quickly exceed the coverage amount. If this happens, your policy can kick in once again and cover an amount above the other driver’s policy. This is the “underinsured” part of an uninsured/underinsured motorist policy.

For instance, imagine your medical bills were $40,000, and the other driver who caused the crash only had $30,000 in coverage. In this case, your underinsured driver coverage could kick in for the additional $10,000. In these cases, it is important to note that you still must prove that you suffered those damages. Your insurance provider may also be less than thrilled about paying the claim and might dispute the amount of your damage or allege you contributed to the crash.

Can I Challenge My Insurer About Their Settlement Offer?

When you make an uninsured motorist claim, your insurance company is effectively stepping into the place of the defendant. Because of this, the negotiations can become complicated. In many cases, you could be bound to an arbitration proceeding in which arbitrators will decide on the amount of compensation. The decision of the arbitrator or arbitrators will be binding.

Do I Need an Attorney to Arbitrate or Pursue an Uninsured Motorist Claim?

You can and should hire an attorney to represent you in an uninsured motorist claim. The process can be complicated, stressful, and challenging to navigate. Now that your insurance company is essentially your adversary, you will need your own advocate to ensure that you are treated fairly and able to collect the compensation to which you are entitled.

Can I Sue the Uninsured Motorist in Maryland?

In some cases, suing the uninsured motorist might be an option, but as mentioned, in many cases, that person will not have assets that you would be able to acquire to cover the costs of your damages. It is important to speak to an attorney about whether this move is the right one, given your circumstances.

Berman | Sobin | Gross LLP’s Maryland Car Crash Attorneys Can Help

At Berman | Sobin | Gross LLP, our Maryland car crash attorneys can help develop a strategy that works for your claim. Call us at 410-769-5400 to learn how we can help you in your uninsured or underinsured motorist claim.